As global economic pressures mount and traditional revenue models face unprecedented challenges, the Gulf Cooperation Council (GCC) is undertaking a decisive and strategic transformation of its economic landscape. The year 2026 marks a pivotal moment where long-term visions are crystallizing into

The stark reality of modern healthcare is that for a significant portion of the population, essential medical services are becoming a luxury rather than a right. A recent survey has cast a harsh light on this issue, revealing that the high cost of care is a formidable barrier for a majority of

The Australian dream of homeownership is being tested against the backdrop of a residential mortgage market that has surged to a record-breaking $2.41 trillion, propelled by a relentlessly appreciating property market. This unprecedented growth is creating a complex and challenging landscape for

In a striking demonstration of a market in transformation, the digital asset landscape of 2025 presented a fascinating paradox where declining spot prices for major cryptocurrencies failed to dampen trading activity, but instead ignited an unprecedented surge in regulated derivatives. While the

The delicate choreography of diplomacy across Northeast Asia is undergoing a profound transformation as nations pivot to address a complex web of new economic realities and persistent security threats. In this shifting landscape, the actions of middle powers are becoming increasingly significant.

In a decisive move to clarify its identity and build on historic market strength, the Singapore Exchange (SGX) announced a major rebranding of its equities business to the SGX Stock Exchange, a declaration made by chief executive Loh Boon Chye during the momentous 60th anniversary celebration of

A striking divergence is emerging between the cautious outlook of financial markets and a bold forecast suggesting the Federal Reserve is on the cusp of an unexpectedly aggressive monetary easing cycle. While investors and policymakers anticipate a slow and measured approach to interest rate

An investment vehicle described by experts as a "super-powered Roth" is now accessible to over six million more Americans, revolutionizing the landscape of financial planning for individuals with disabilities. As landmark legislative changes broaden eligibility, Achieving a Better Life Experience

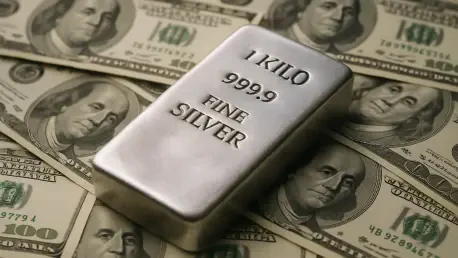

From Record Highs to a Reckoning Charting Silvers Whiplash Moment After a meteoric ascent that seemed to defy gravity for months, silver's breathtaking rally slammed into a wall of turbulence, leaving investors questioning if the peak is truly behind us. The market was thrown into chaos as the

Priya Jaiswal, a recognized authority in banking and international business trends, joins us to dissect Meta's blockbuster acquisition of the AI startup Manus. In a tech landscape defined by an escalating arms race, this multi-billion-dollar deal is more than just a transaction; it's a strategic

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy