The Indian financial market is currently navigating a period of unprecedented transformation, where a massive surge in retail investor enthusiasm collides with a wave of stringent regulatory oversight. It is within this dynamic and challenging environment that Jainam Broking, a full-service

For decades, the lucrative world of private credit has remained a walled garden, accessible only to large institutional investors and the ultra-wealthy who could meet steep minimums and tolerate long lock-up periods. This exclusivity has left individual investors on the sidelines, unable to tap

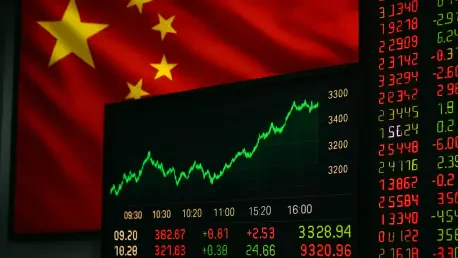

After a prolonged period of being deemed "uninvestable" by a significant portion of the global investment community, China's stock market is staging a formidable comeback, fueled by a powerful combination of decisive government intervention and significant domestic advancements in artificial

A rare and powerful signal is quietly brewing within the complex architecture of the Bitcoin derivatives market, a development not seen with such intensity since the profound market bottom of August 2024. This indicator, characterized by extremely negative funding rates, points to a market

The complex and often opaque landscape of the European Union's over-the-counter derivatives market has long presented a formidable challenge for participants seeking a clear, unified view of trading activity. In a significant move to address this pervasive fragmentation, Etrading Software has

Navigating the vast and dynamic world of foreign exchange and CFD trading requires a broker that not only provides robust tools but also operates with a level of transparency that fosters trader confidence. Pepperstone, an Australian-based broker founded in Melbourne, has carved out a significant